BENEFITS

-

Speed & Service

Improve time-to-yes by 70% and time-to-cash by 50%

-

Efficiency & Management

Increase loan processing efficiency by 30% or more, while lowering credit risk

-

Transparency & Control

Monitor performance in just two clicks

-

Data Mobilisation

Consolidate internal and external databases to better make use of client data

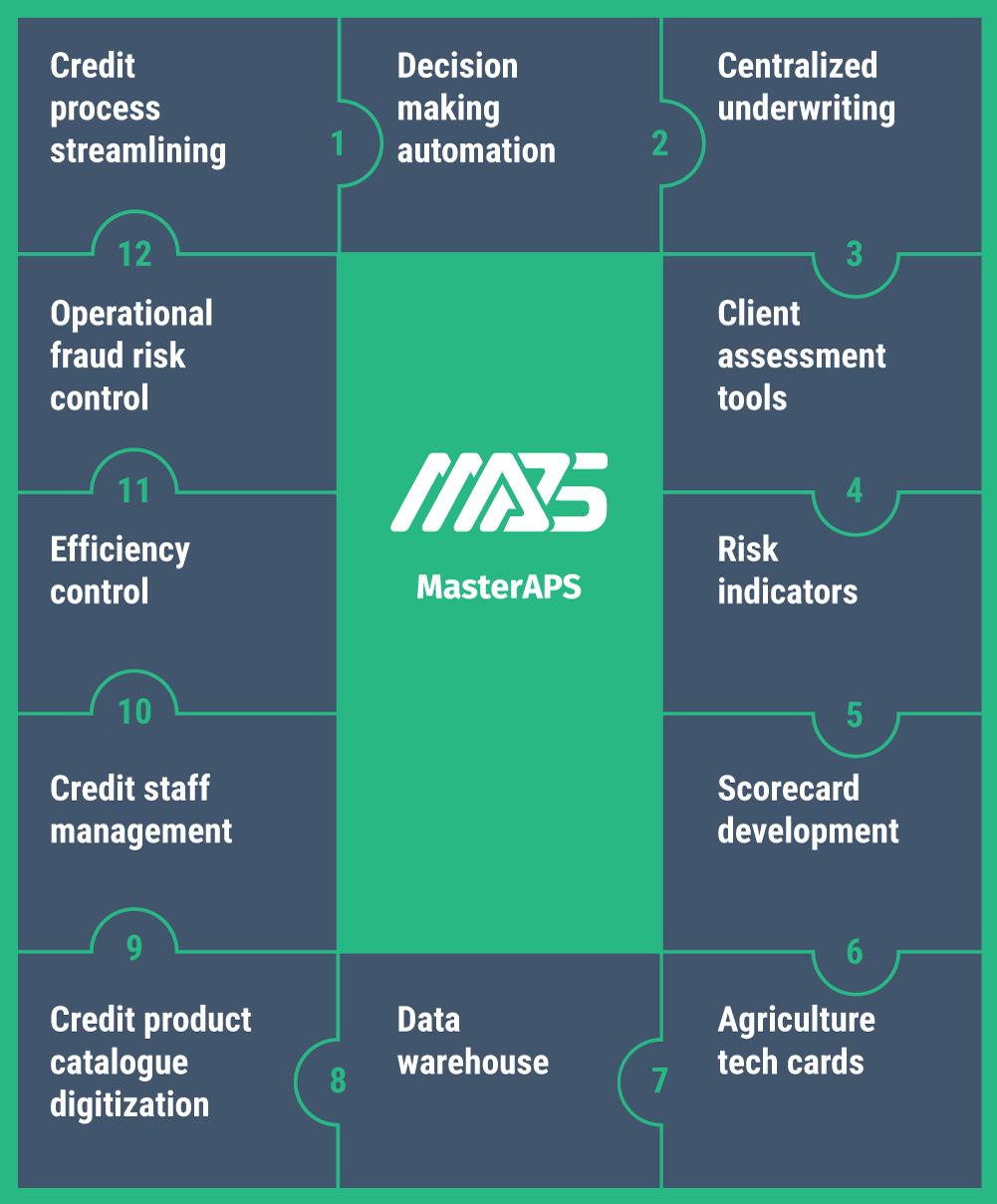

FEATURES

MasterAPS is a secure application processing system (APS) that is fully-customizable to your data and team needs. With advanced data management, easy reporting and extensive connectivity, loan processing has never been easier.

Make your credit process smarter

MasterAPS is a loan application processing system (APS) that makes lending cycles fully-automated. The intuitive interface also makes the credit process easier for every user — from front office staff to senior management.

Result: Improved time-to-yes and time-to-cash

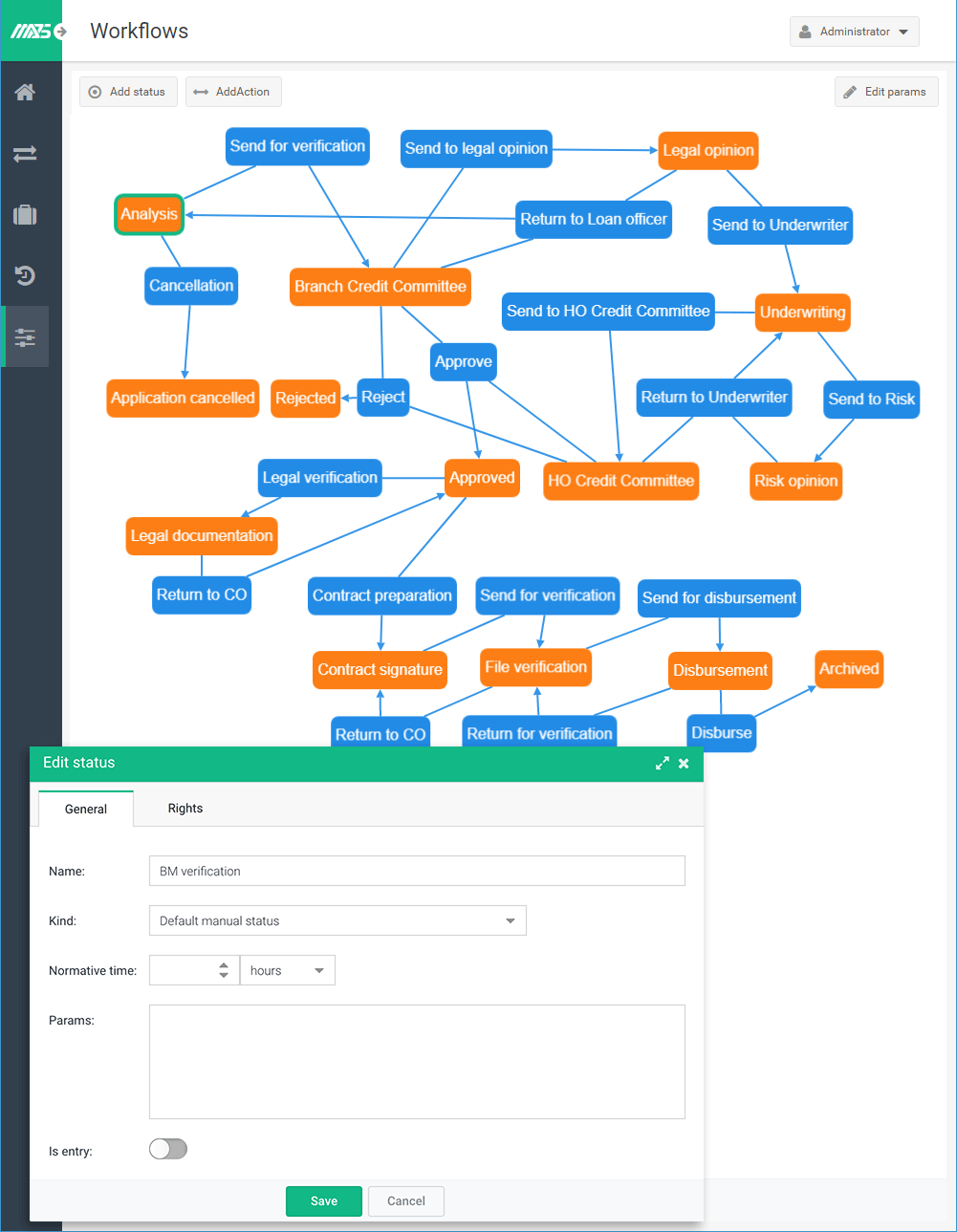

- Configure your own rule-based workflow

- Easily monitor the status of applications

- Implement tailored actions

- Include an unlimited number of users, workflows and products

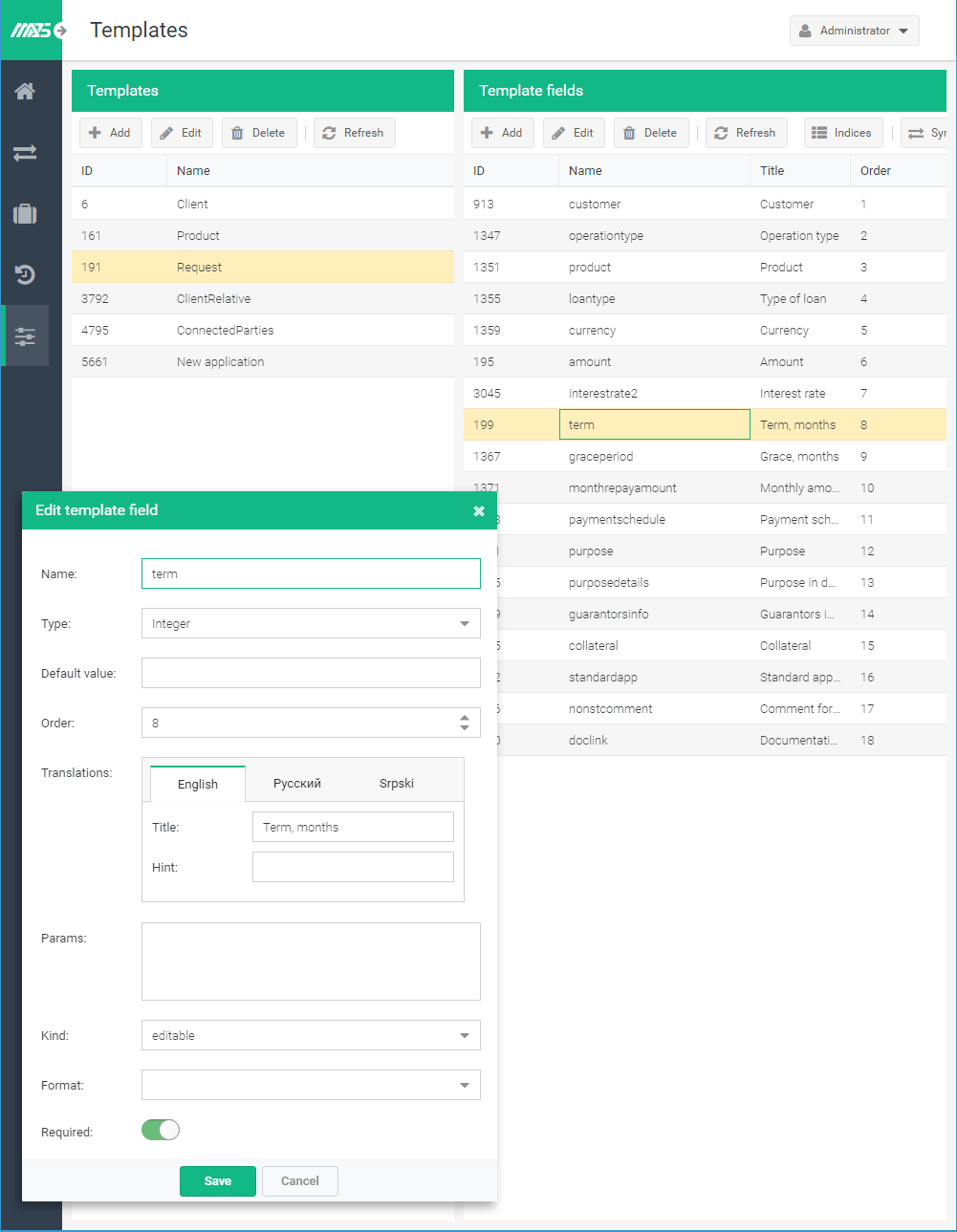

- Create customized templates

- Attach any file to an application

- Access MasterAPS from any computer or tablet connected to the internet

- Receive auto-generated email and SMS notifications

- Use the platform in the language of your choice

- Access MasterAPS functions offline from Android and iOS devices (coming soon)

- Keep track of communications with the built-in user chat function (coming soon)

- Ensure all steps in the loan process are completed with customizable checklists (coming soon)

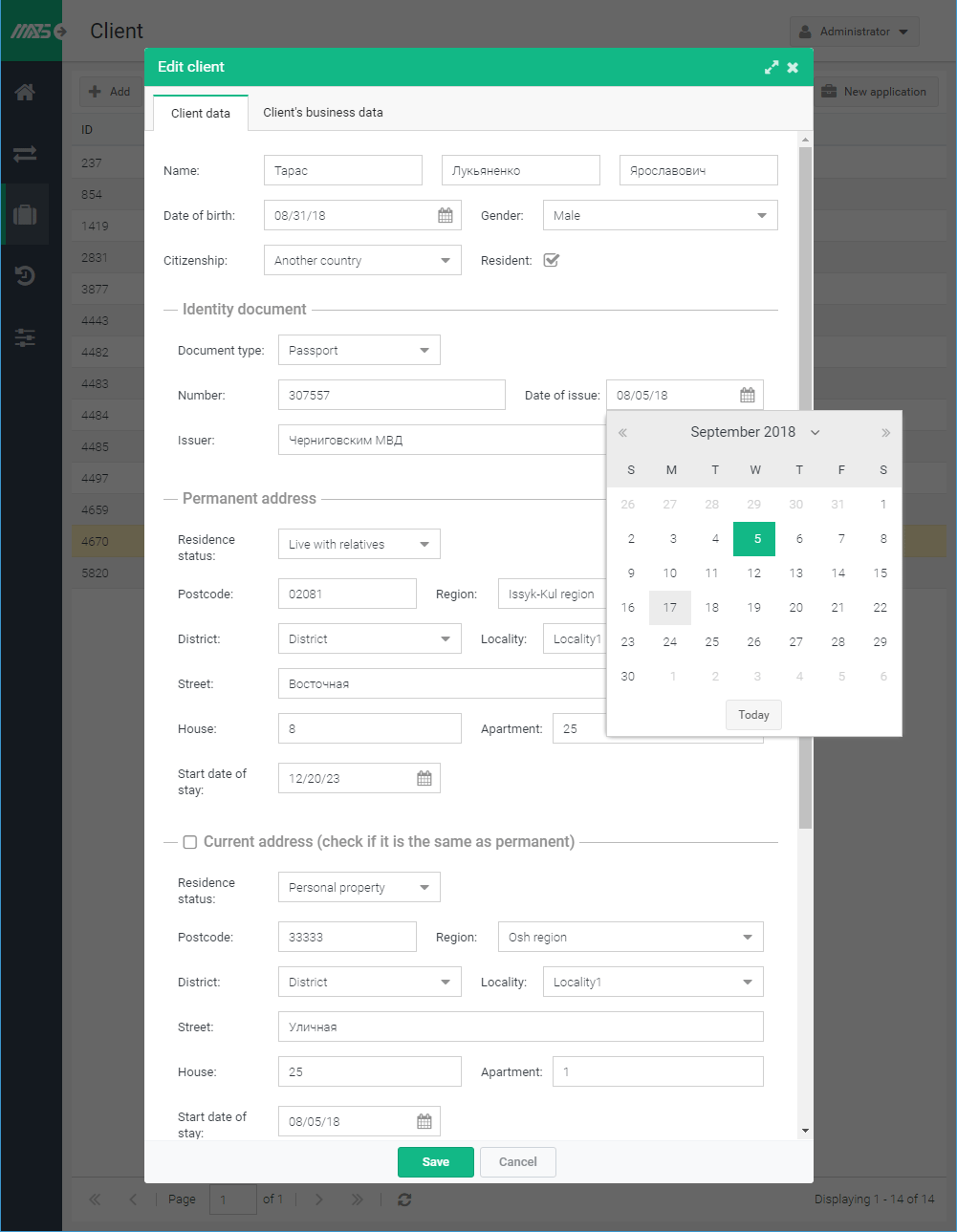

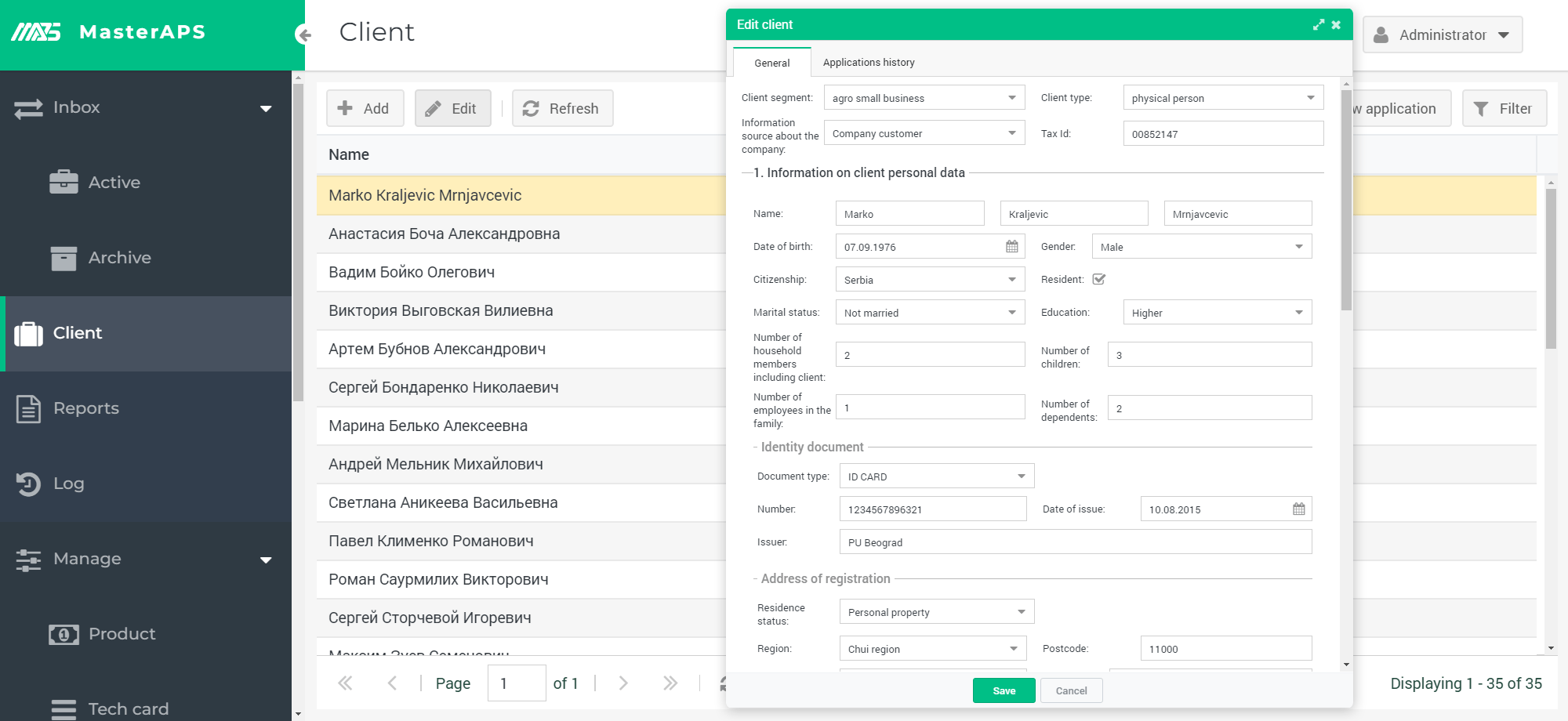

Securely analyze and store client data

MasterAPS removes the hassles caused by paper-based workflows and email chains by saving all client data in a single profile, with each loan application and other supporting documents and information linked to the client profile. MasterAPS can even be linked with other internal and external data sources to obtain a richer pool of data.

Result: All client data in one place

- Use data entry validation to ensure all data is appropriate

- Extract data with simple, easy-to-use processes

- Easily upload any type of file

- Integrate MasterAPS with your CBS, CRM, ERP, or cloud servers

- Connect with external data sources

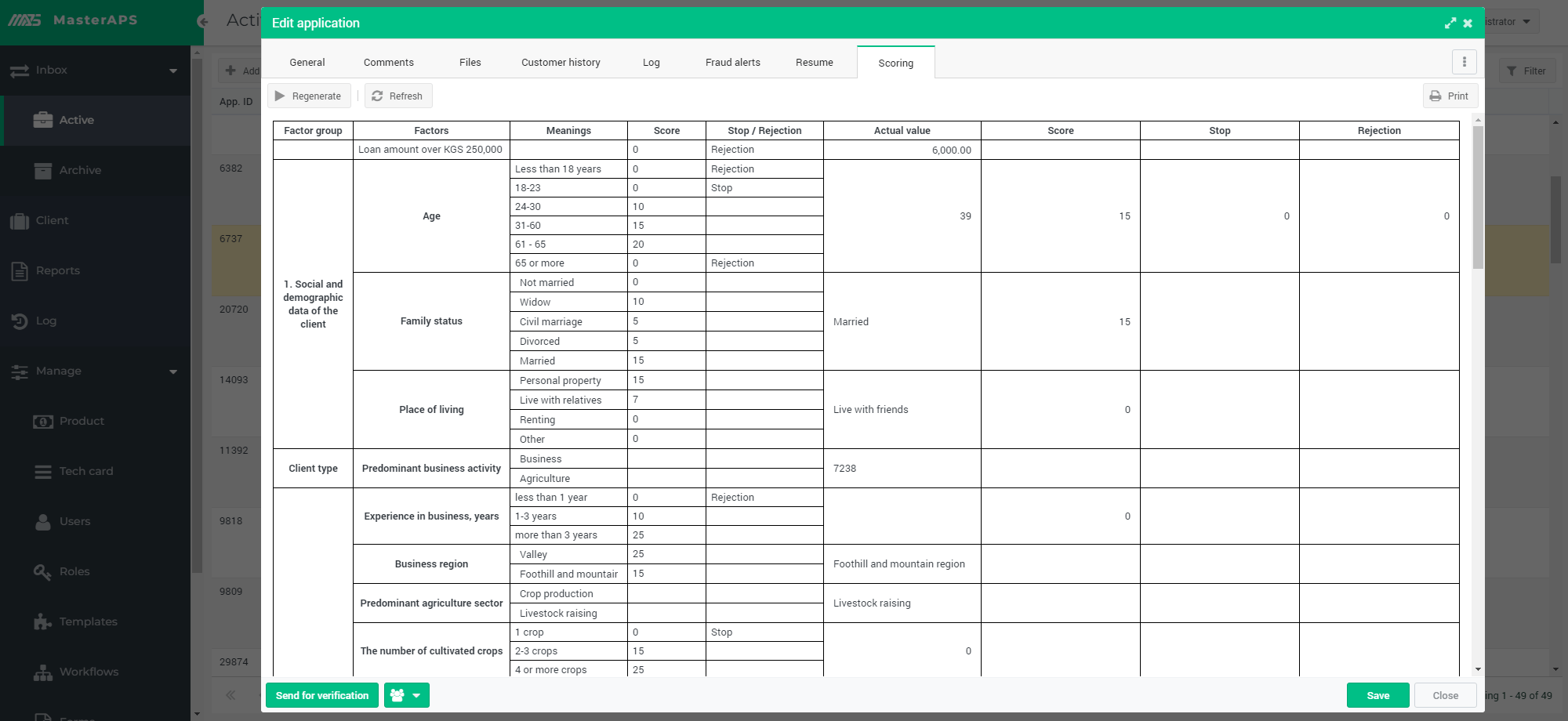

- Develop smart statistical credit scoring

- Enhance your processes with support from BFC’s world-class experts

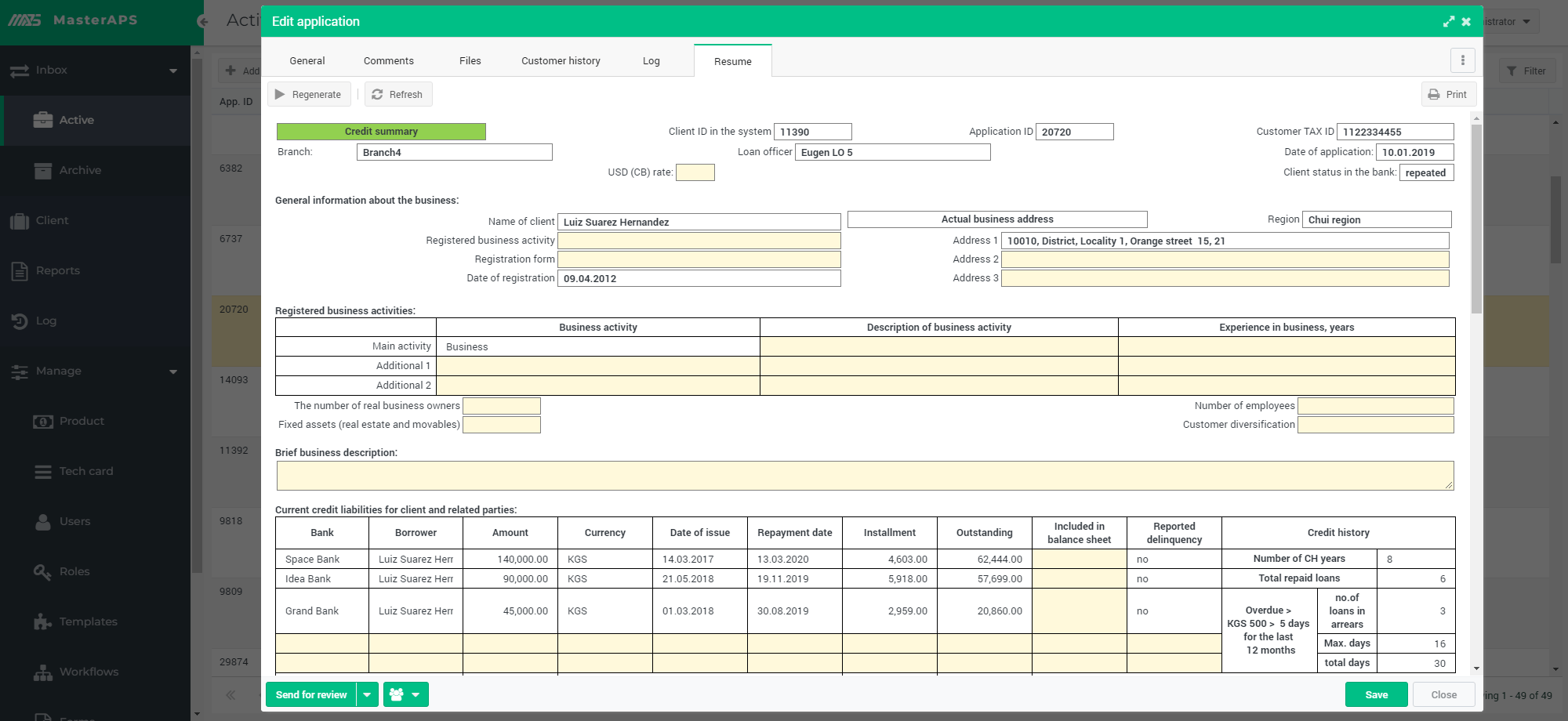

Get all the information needed to make the right loan approval decisions

Configurable web-based appraisal forms work seamlessly with smart risk assessment tools to quickly and easily assess creditworthiness. MasterAPS also guards against input errors and ensures credit and operational risk levels are exactly as desired.

Result: 30%+ increase in your loan processing efficiency without increase of risk

- Configure client evaluation criteria to match needs

- Use web-based forms with Excel-like formula engine for easy and accurate data entry

- Employ expert or statistical credit scoring to make stronger decisions

- Enhance agricultural lending with agricultural technical cards

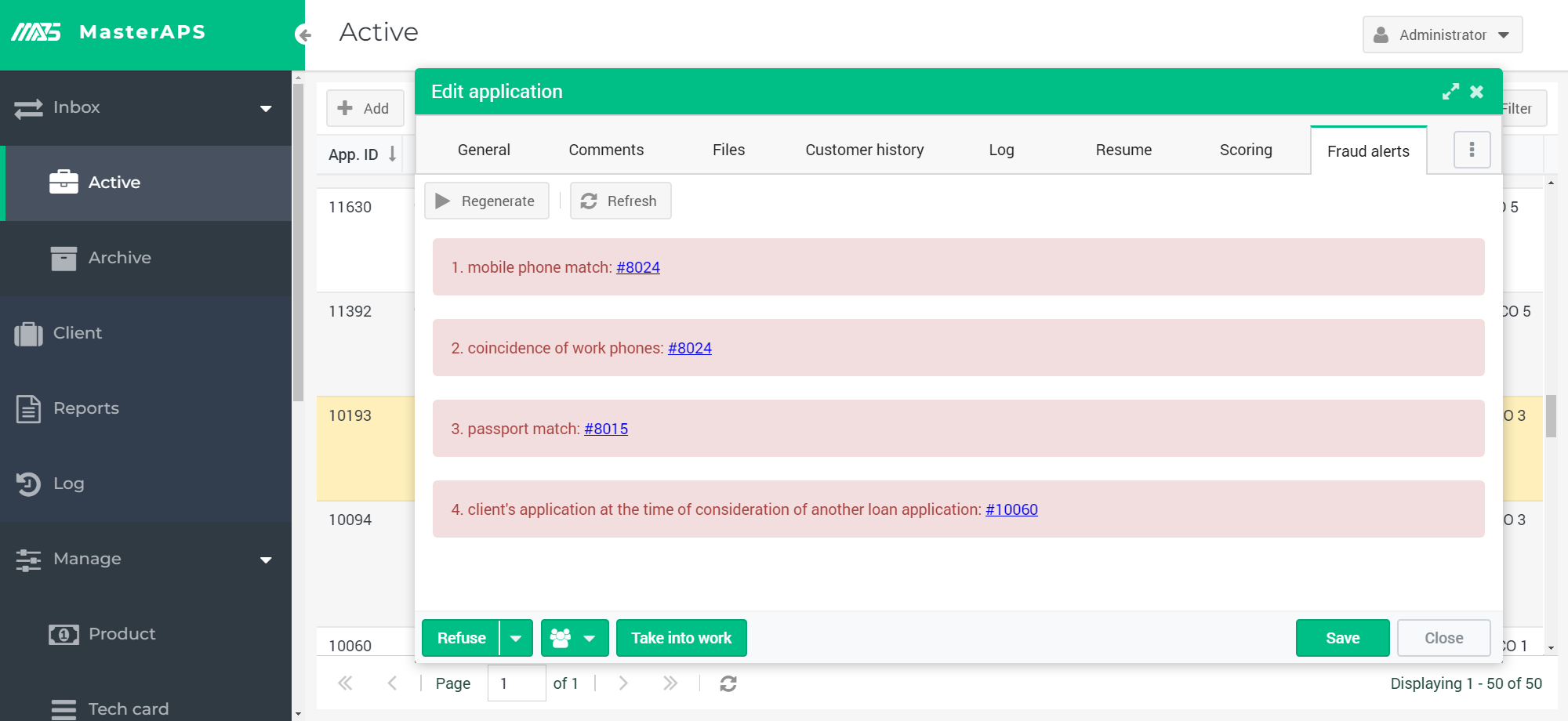

- Receive automated fraud alerts

- Customize web and printable forms

- Access MasterAPS on tablets while in the field

- Send clients approval notifications automatically (coming soon)

Stay efficient and make clients happy

MasterAPS was designed to make lending process faster and easier for both credit staff and clients, providing a higher quality of service while using less resources.

Result: Improved time-to-cash; increased client retention

- Ensure data integrity through integration with the CBS

- Increase productivity

- Better manage staff

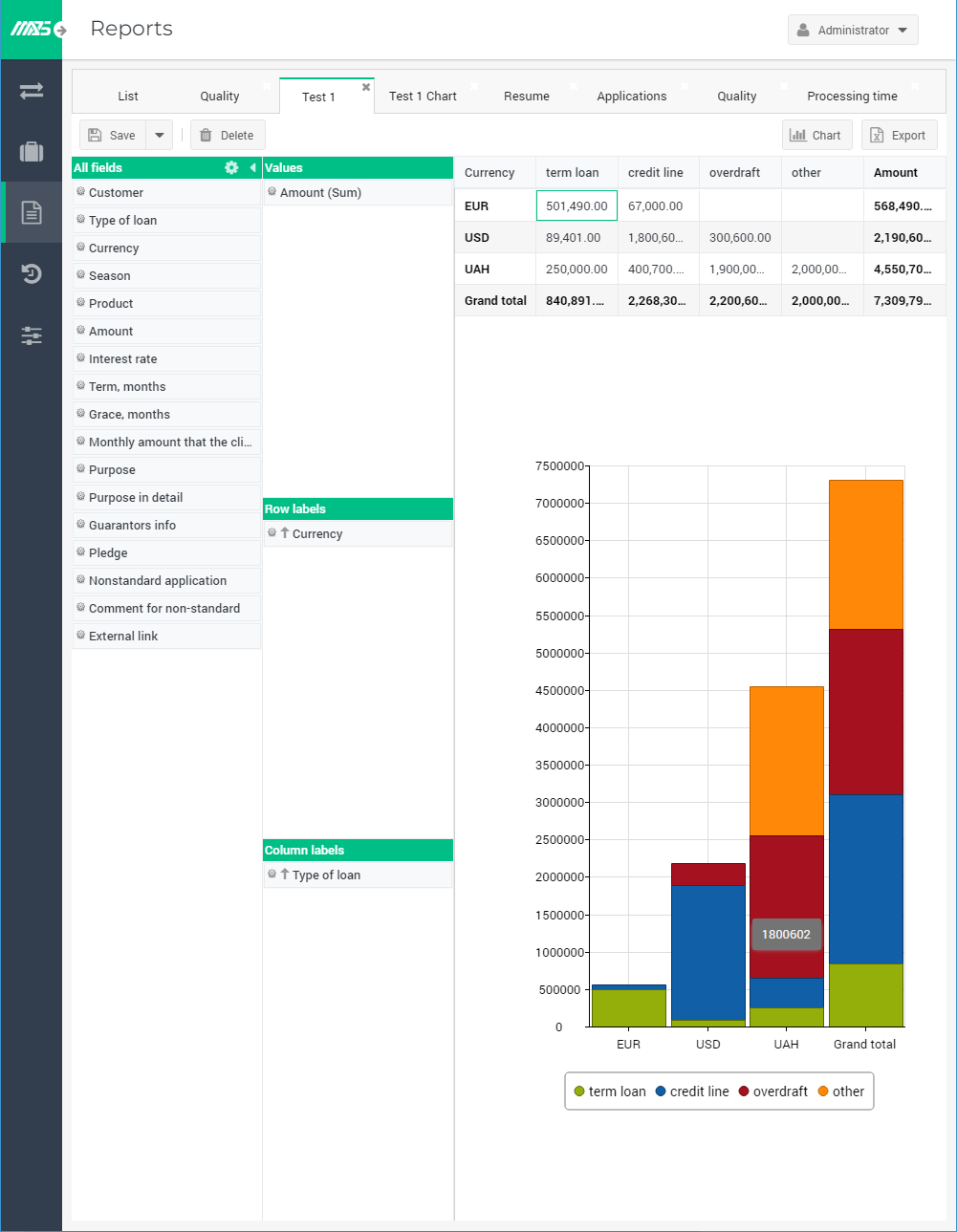

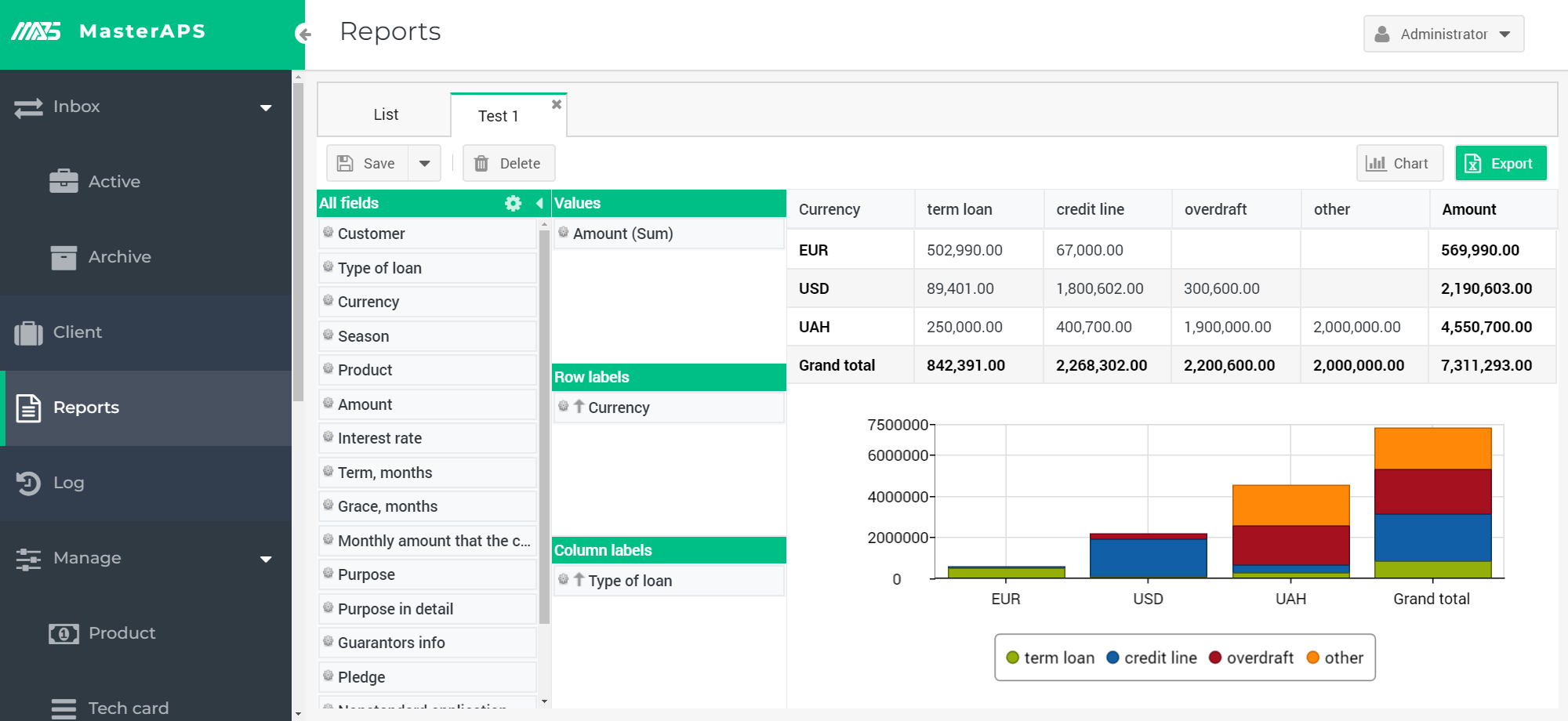

- Create customized reports with the easy-to-use OLAP reporting engine

Maximize the impact of MasterAPS with support from our expert team of credit and IT professionals

BFC’s experienced team of credit and IT professionals provides support for the improvement of each step of the loan process, optimizing it to match organizational needs and system capabilities.

- Benefit from BFC’s 15 years of experience in improving loan processes and lending operations

- Let BFC’s Credit Factory Service review and optimize processes and systems at each stage of loan origination

- Get the best of both worlds with BFC’s team of credit process experts and IT professionals

Product Tour

Reshape loan processing with MasterAPS

-

Application Processing System

-

Loan Application Routing and Processing Toolkit

MasterAPS is a loan application processing system used for credit cycle design, loan origination, borrower evaluation, data exchange, storage, and reporting — all in one easy-to-use application.

-

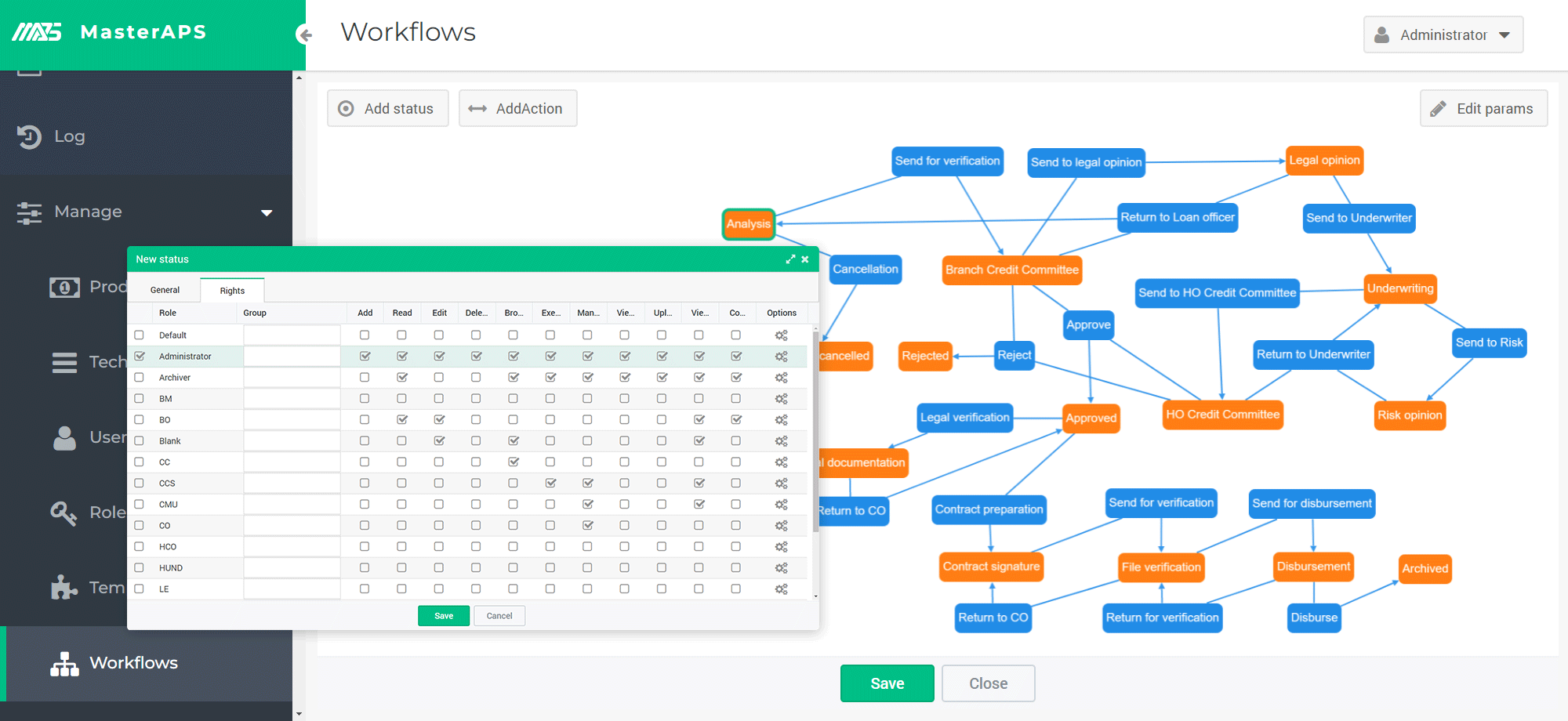

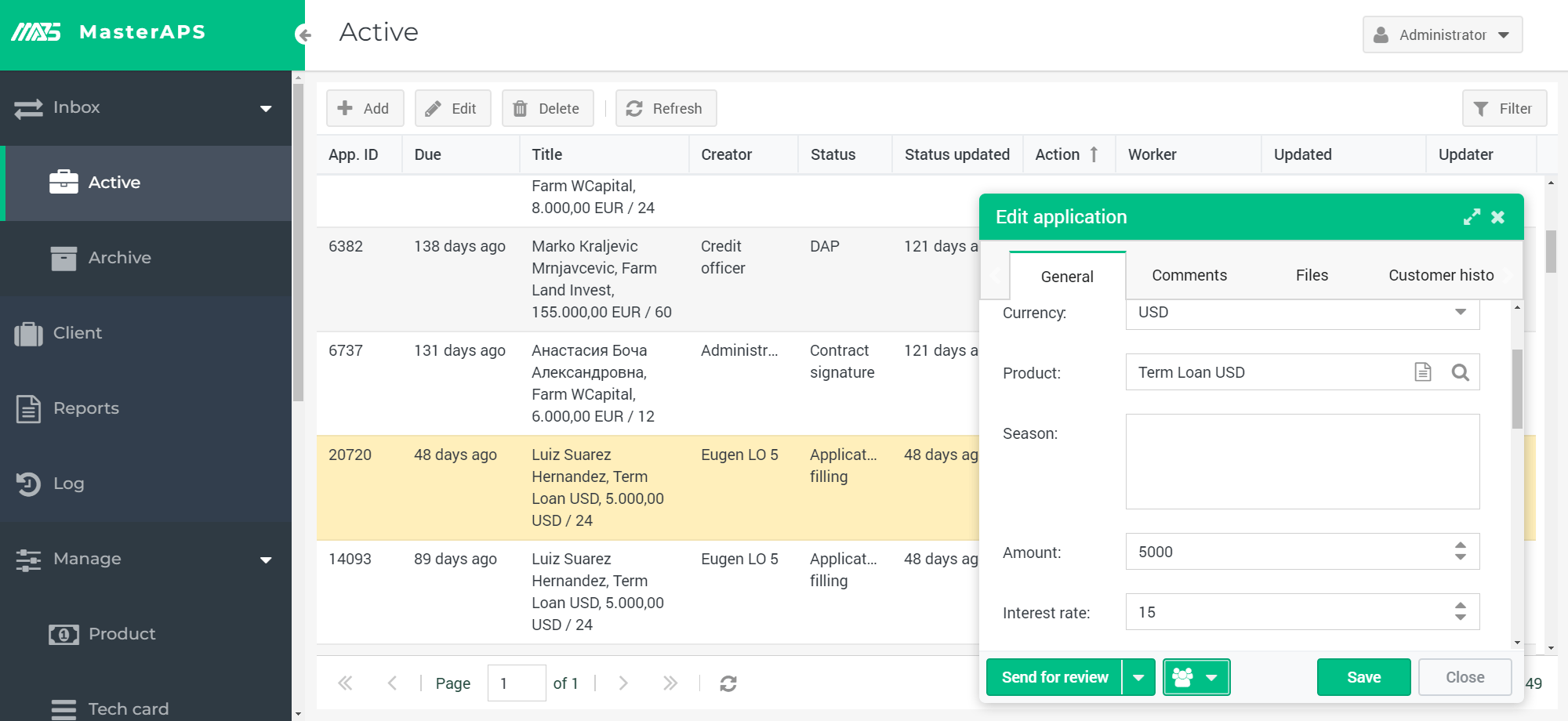

Credit Cycle Design

MasterAPS lets you easily design any credit cycle. You can customize and manage as many different credit cycles as needed, ensuring that they are perfectly in line with your organizational setup and decision-making limits.

-

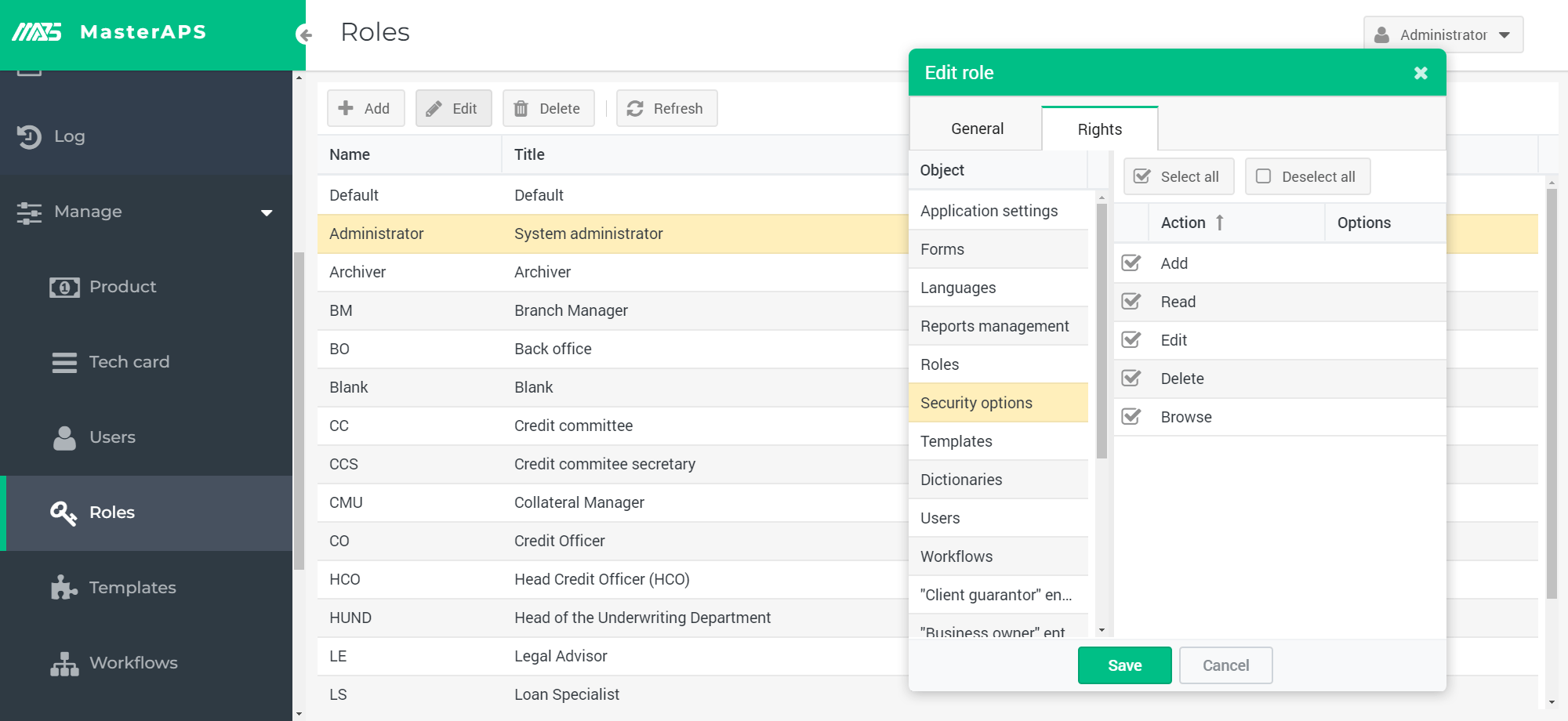

Organizational Structure Mirroring

MasterAPS reflects your organizational structure and credit cycles, offering unlimited options to add users and manage their accessibilities.

-

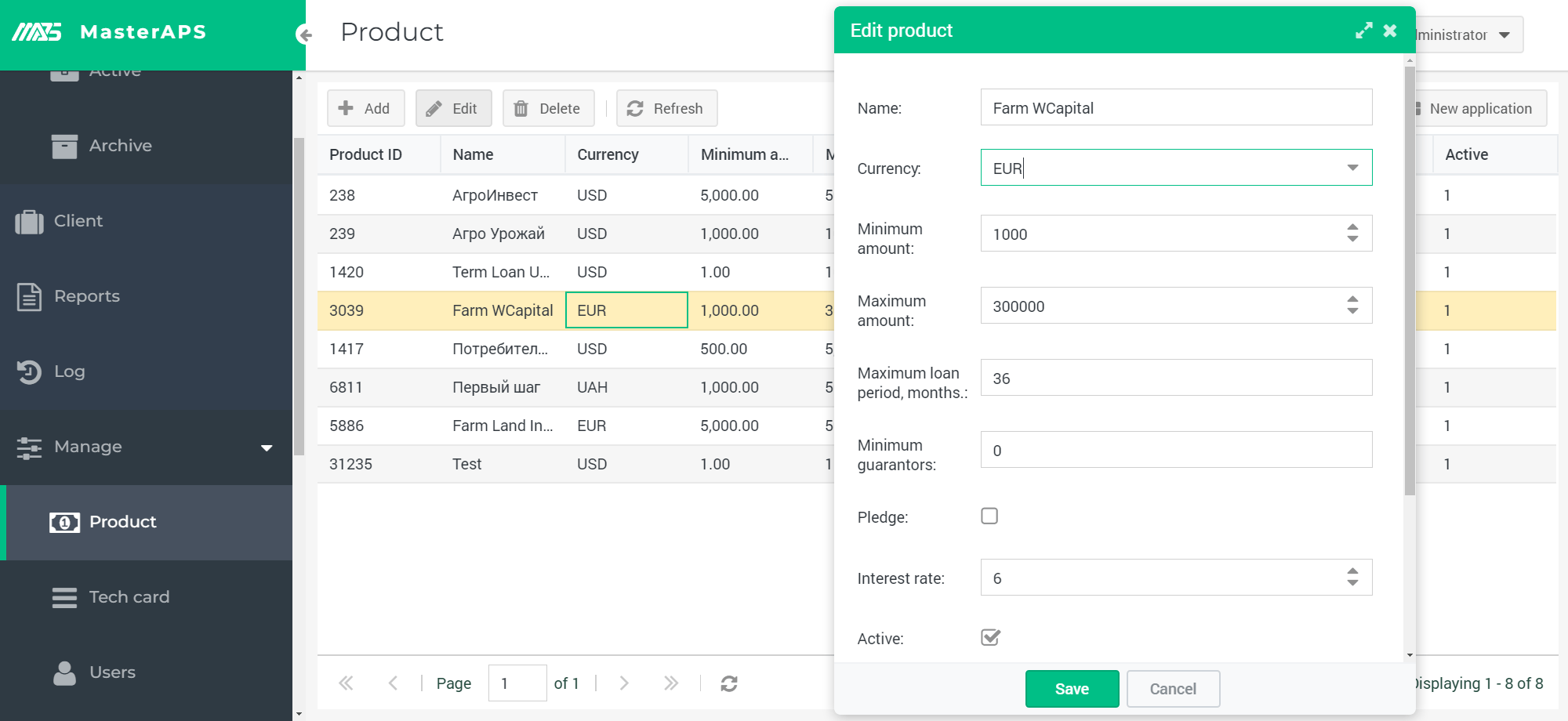

Credit Product Management

MasterAPS enables you to create and manage as many products and credit cycles as needed.

-

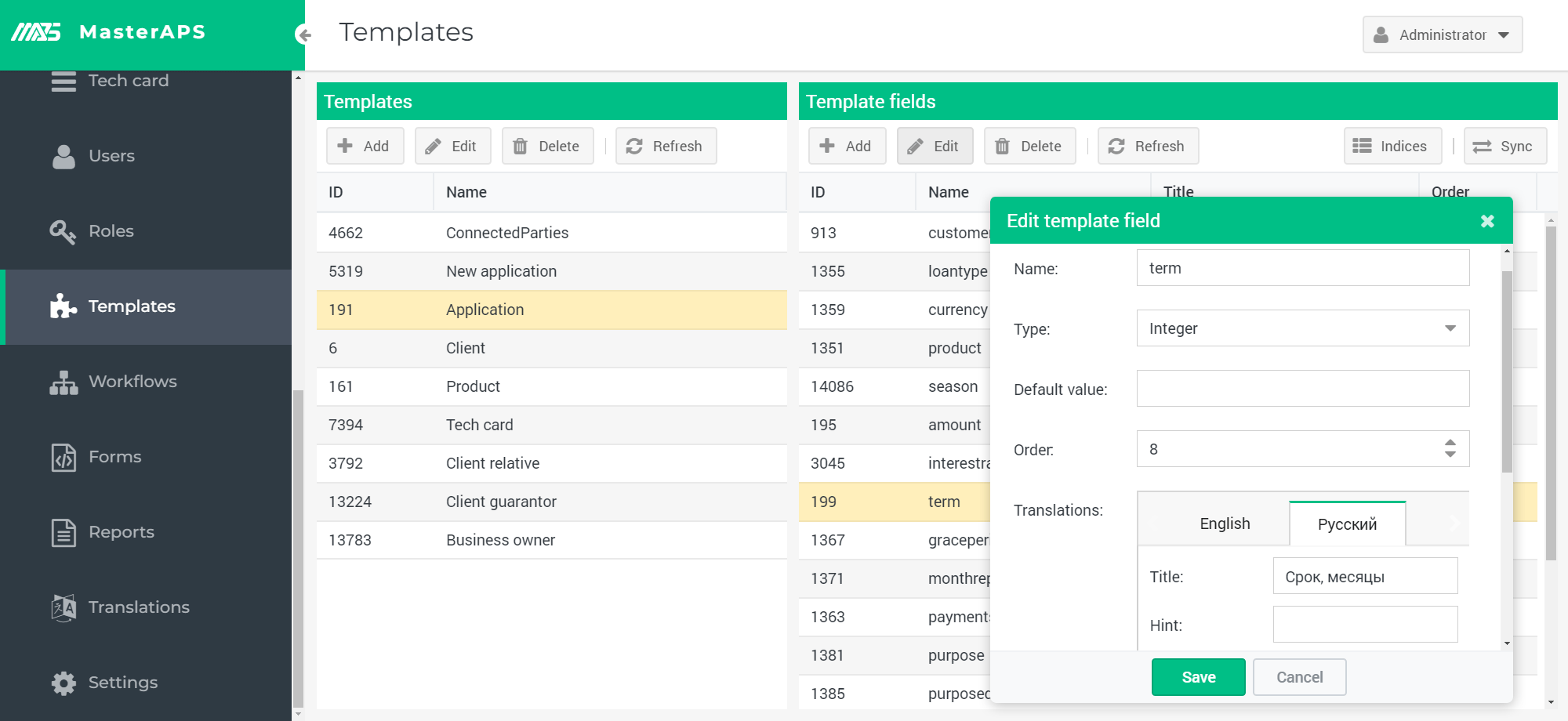

Credit Form Design and Management

MasterAPS supports the effortless design and management of credit forms, including customized input fields, data submission options from in the field and the creation of printable forms.

-

Database Integration

MasterAPS can be integrated with your existing client database or can be used to build a new comprehensive database from scratch.

-

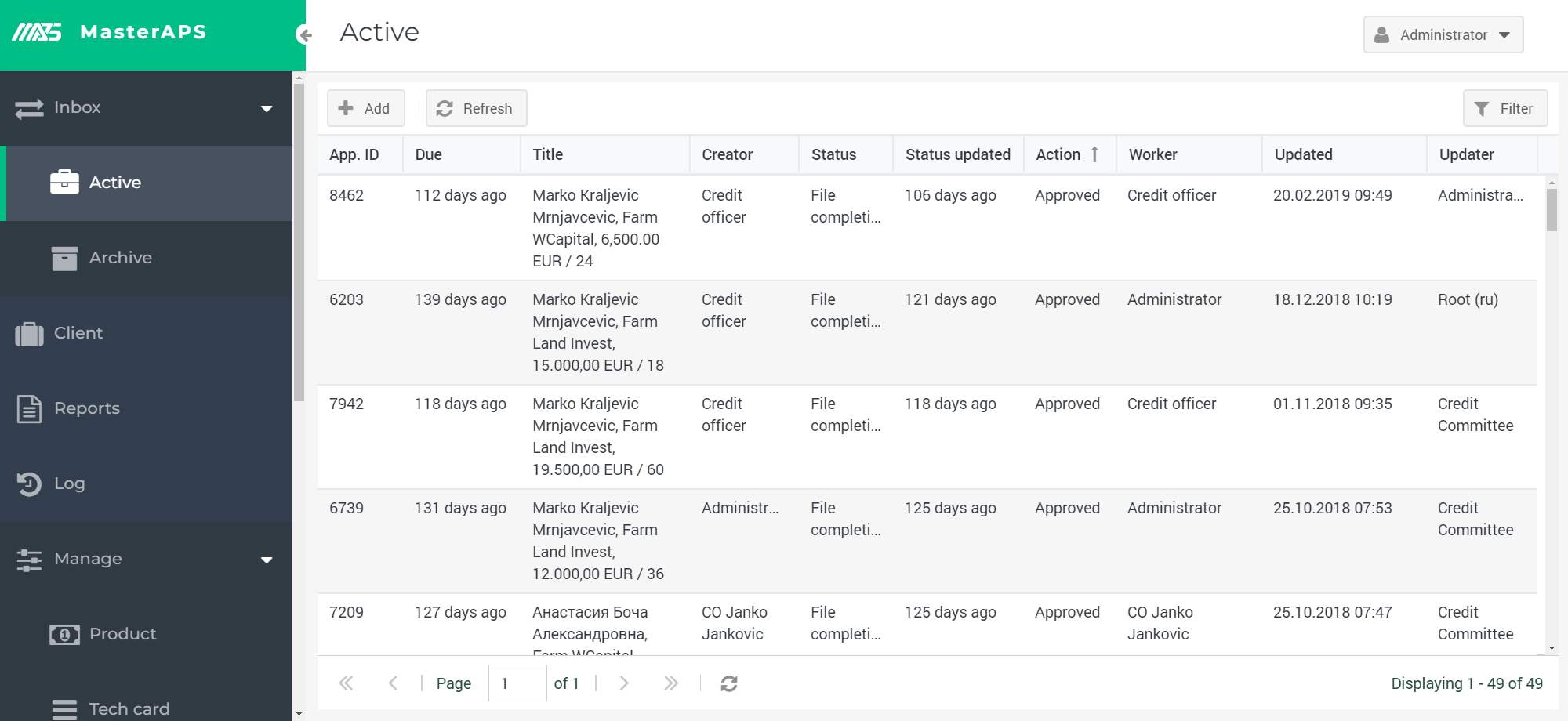

Loan Application Monitoring

Users can quickly view applications (both active and archived) via user-friendly tabs that make it simple to access the entire application. Automatic email/SMS notifications also keep users up-to-date whenever the application status changes.

-

Digitized Credit Appraisal Forms

MasterAPS can effortlessly evaluate client creditworthiness based on configurable specifications.

-

Digitized Credit Scoring

MasterAPS includes a built-in configurable expert credit scoring form that enhances client appraisal and decision-making. MasterAPS also integrates with internal and external data sources to capture all relevant data necessary for statistical credit scoring.

-

One-Click Reporting

MasterAPS’s powerful reporting engine allows for one-click access to view key indicators such as processing time and disbursement statistics through standard pre-configured reports. Additionally, the OLAP report builder allows for fully-customizable analytical reports to be created in just a few drag and drop actions.

-

Alerts and Notifications

MasterAPS sends alerts when a fraud attempt has been detected. It also sends notifications for new loan application submissions and when an existing loan application status changes.

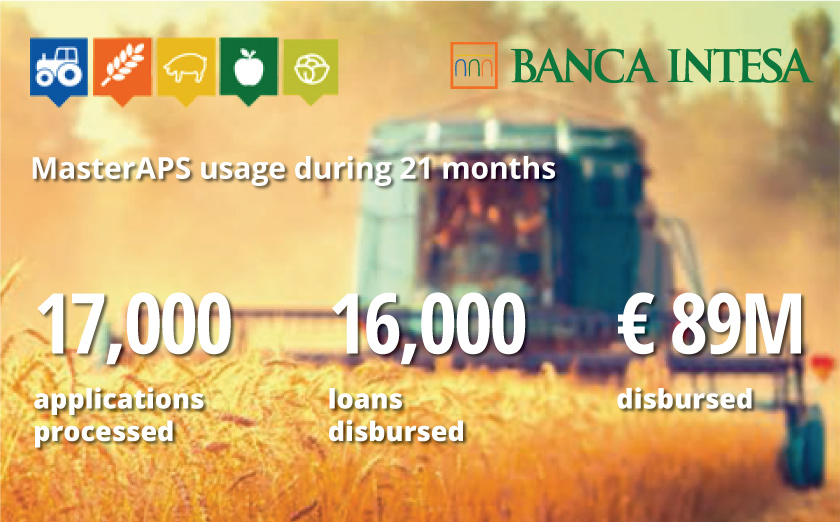

What we show; we deliver

Request a live demo to see MasterAPS in action

Trusted by

What Our Clients Say

BFC’s APS, with its variety of built-in and customized reports, provides us effective control over sales force results and efficiency, operational activities, and decision-making statistics. Moreover, we are now in a position to collect and store all financial and non-financial data for a challenging client group. A huge and valuable database was already collected within one year of using BFC’s APS.

Banca Intesa a.d. Beograd (Serbia)

[September 2018]

With BFC’s APS we have optimized our decision-making process, reshaping it and easily moving from a fully centralized model to semi-centralized. After implementing BFC’s APS within our standard decision-making process, we managed to reduce processing time by 30%. With partial decentralization of the process through BFC’s APS we expect to reduce it by 50%.

Banca Intesa a.d. Beograd (Serbia)

[September 2018]

Success Story:

How automation and digitization increased productivity by 25% at Banca Intesa Serbia

Learn how a leading Serbian bank more than halved loan processing and approval times thanks to BFC’s MasterAPS loan origination system.

Read more...Schedule a demo with one of our experts

FAQ

Frequently Asked Questions

- Can MasterAPS be used as a core banking system?

- MasterAPS is a separate module used for efficient credit cycle management. It could be easily connected to any core banking system.

- Is it possible to manage document workflow by transferring and saving files in this software?

- Yes, MasterAPS features transferring and saving of any type of file.

- Can a loan agreement be automatically generated in MasterAPS?

- Yes, the system is capable of generating adjustable printable forms (e.g. loan applications or loan agreements).

- Does MasterAPS have any built-in reports?

- MasterAPS has built-in reporting tools based on the Online Analytical Processing (OLAP) engine, which allows for fully-customized reports.

- Does MasterAPS have any tools to evaluate the creditworthiness of borrowers?

- Yes, MasterAPS has a built-in configurable credit evaluation form that allows financial institutions to perform financial analyses of borrowers.

- Can MasterAPS be used on mobile devices such as smartphones, tablets etc.?

- Yes, MasterAPS can be used from any mobile device supporting a browser (subject to internet connectivity). Android and iOS apps capable of working offline are coming soon.

- What is the maximum number of users allowed under a standard MasterAPS license?

- The number of users and business roles is unlimited.

- Is there a maximum application flow or loan portfolio size that MasterAPS is capable of supporting?

- There are no such limitations.

- How many loan products and different workflows is MasterAPS capable of handling?

- There is no limit to the number of loan products and workflows.

- Is it possible to connect MasterAPS with external data sources (e.g. a credit information bureau or core banking system)?

- MasterAPS is capable of online connections with a credit bureau, a core banking system or any other database with available APIs.

- Does MasterAPS have a specialized client interface that allows customers to apply for a loan online?

- MasterAPS features roles for all bank employees who are engaged in the credit process. A separate module for clients can be developed upon request.

- How is MasterAPS accessed?

- The system can be made available as a secured SAAS service (i.e. the client doesn’t need a server). Alternatively, software can be installed on the central server of the financial institution. In either case, users access and use the system via a web browser.

- How long does it take to customize and install MasterAPS?

- It depends on the complexity of the custom settings and the specific requirements to integrate MasterAPS with other software and external databases. Typically, the implementation process lasts 2–6 months.

- If we purchase MasterAPS and later need to modify or add new loan products, roles or users, how quickly can these changes be made?

- BFC transfers all necessary documentation and trains your system administrators to easily make such adjustments to MasterAPS. Alternatively, BFC can provide the relevant support based on a separate maintenance agreement, if desired.

- MasterAPS is not available in a language we need. Can MasterAPS be customized to any other languages?

- Yes, MasterAPS can be easily customized to any language within a very short period of time.

- What support services are included with a MasterAPS purchase?

- Unlimited bug fixing and maintenance is free of charge for the first 6 months after system implementation. Following this period, it is recommended that clients subscribe to a maintenance service.

- What type of maintenance service contracts are available?

- Yearly service packages including unlimited maintenance and bug fixing as well as a fixed number of development days dedicated to the development of requested customizations. Alternatively, a pay as you go service is also available under which charges are based on expert time spent completing the requested actions.

- What guarantees are given on quality of support services?

- BFC guarantees a response to all reported key issues with the system within 1 working day.

Still have questions?

Feel free to ask any other question you may have; one of our experts will respond to your questions directly.

Packages

Features for every financial institution

- Route your incoming loan applications

- Set your workflow and organizational structure

- Manage your credit products and clients

- Receive alerts and notifications

- Design and manage forms

- Exchange and store documents

- Analyze performance with configurable operational reports

- Includes all Standard Features

- Evaluate your borrowers

- Communicate via chat

- Analyze every detail of your business with powerful operational and financial reporting engine

- Access on Android and iOS

- 3 months free premium support

Contact us for a tailored quote

We’d love to learn more about your needs for a great MasterAPS experience.

Complete the short form and a MasterAPS expert will contact you directly to answer all your questions.